03.20.19

The global electronic contract manufacturing and design services market size was valued at USD$391.4 billion in 2018 and is anticipated to expand at a CAGR of 7.9% from 2019 to 2025. Growing functionalities such as component assembly, engineering and design of printed circuit boards, sub-assembly manufacturing, and functional testing offered by contract manufacturers are expected to drive the market over the forecast period.

Electronics manufacturing services are a form of engineering and manufacturing outsourcing services that provide a wide range of core manufacturing capabilities. Moreover, outsourcing of ancillary activities helps OEMs focus on their core competencies, which further helps them improve their operational efficiencies and reduce production costs and need for fixed capital investment.

The EMS model is driven by a contract manufacturer’s ability to specialize in economies of scale in services, industrial design expertise, raw material procurement, and pooling resources, along with offering value-added services such as warranty and repairs. These allow OEMs to avoid having tedious or complex large-scale industrial operations. Moreover, OEMs outsource their circuit assembly requests to reduce time-to-volume and time-to-market production through utilization of technology solutions, design and engineering services, and manufacturing services by EMS providers. On account of these factors, the market for electronic manufacturing services is expected to gain traction over the forecast period.

The proliferation of mobile devices such as tablets and smartphones has been the key growth propeller over the last few years. The medical industry is anticipated to witness significant growth owing to increasing demand for medical devices. Manufacturing of medical devices requires advanced technology and strict regulatory compliance. Thus, outsourcing such activities enables OEMs to accelerate R&D activities and reduce the cost of devices in order to gain a competitive advantage.

Furthermore, automotive and aerospace and defense industries are projected to witness higher growth in comparison to the IT and telecom sector. Despite EMS providers having numerous advantages in the manufacturing processes, contract manufacturing cannot always be the best option for OEMs. Many times, OEMs fail to understand that outsourcing the assembly processes can be more time-consuming and complicated than in-house services. Moreover, maintaining quality, cost control, and production volumes are expected to hamper the manufacturing services provided by EMS contract providers. In the process of passing on the responsibility of manufacturing to experts, OEMs end up making the relationship with contract manufacturers less profitable.

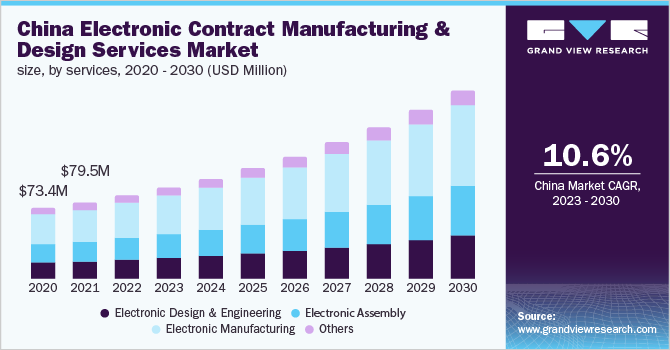

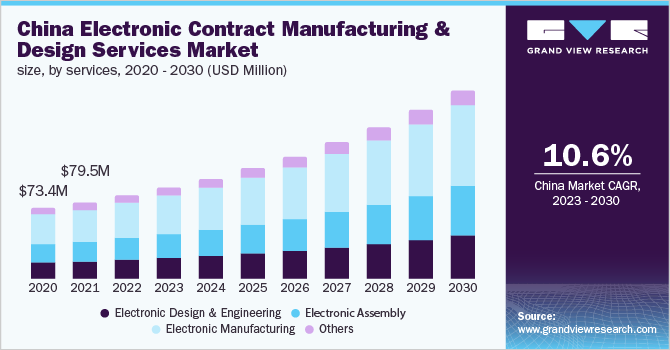

Electronic manufacturing emerged as the leading service segment in 2018 and accounted for over 40% share of the overall revenue that year. However, the electronic design and engineering segment are projected to witness high growth over the forecast period owing to a surging inclination of OEMs toward outsourcing their designing requirements.

The EMS market is witnessing an upsurge in demand for electronic circuit boards due to their rising importance in several electronic devices such as mobile phones and tablets. Furthermore, OEMs can design and test prototypes for new product development. Additionally, services provided by contractors enable less capital investment and advanced manufacturing techniques to OEMs for new product development. Hence, OEMs are increasingly outsourcing their circuit assembly requirements to EMS providers, which substantially increases their profit margins. Owing to the aforementioned factors, demand for EMS is anticipated to upsurge over the forecast period.

Furthermore, OEMs are increasingly considering outsourcing design and engineering activities to reduce operational costs and improve flexibility. They are extensively investing in R&D activities and other initiatives to streamline their production processes in order to sustain in the highly competitive environment. However, utilization of advanced technologies, such as 3D printing and Artificial Intelligence (AI), by EMS providers for automation results in high-initial investment by OEMs. Moreover, the establishment of in-house production is a key challenge faced by the majority of the manufacturers. Thus outsourcing is a preferable option for OEMs to keep pace with growing competitive environment.

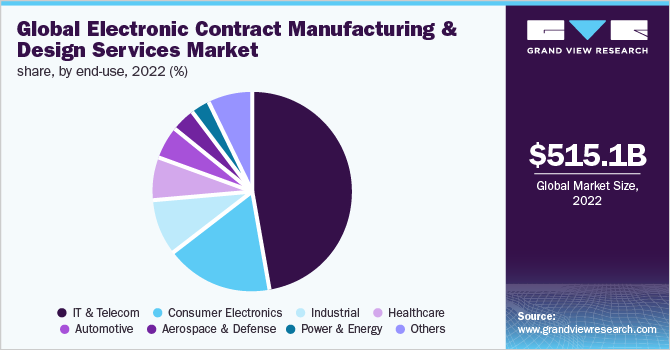

Demand for EMS is anticipated to increase owing to the rise in applications across end-use sectors such as healthcare, automotive, industrial, and aerospace and defense. Low penetration of EMS in these sectors is creating higher opportunities for contract manufacturers to establish a strong foothold in these industries.

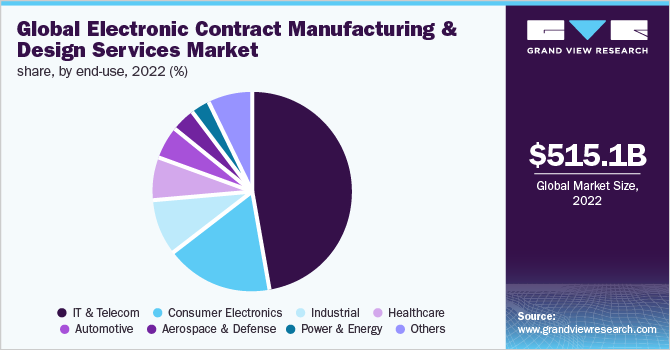

The IT and telecom sector emerged as the largest end-use segment in the electronic contract manufacturing and design services market and accounted for over 45% of the total revenue in 2018. However, the growing trend of manufacturing outsourcing in the healthcare, automotive, defense, and other segments are projected to spur their market shares over the forecast period.

Furthermore, an upsurge in demand for electrical vehicles has elevated the need to outsource electronic component manufacturing, thereby spurring EMS demand in the automotive sector. The healthcare industry is anticipated to witness significant growth owing to the rise in demand for medical devices. These include computed tomography scanner assemblies, blood analyzers, ultrasound imaging systems, and blood glucose meters.

Escalating need to optimize resources, low fixed capital investment, and improved product development emerged as the key factors contributing to the EMS market expansion across several end-use industries, such as medical, automotive, aerospace and defense, consumer electronics, and IT and telecommunication.

Asia Pacific is expected to witness the highest growth, followed by North America, which is attributed to the rise in outsourcing activities in these regions. Asia Pacific held the largest share in the market in 2018 and is estimated to remain the fastest-growing segment over the forecast period. China accounted for more than 30% share of the overall revenue in 2018 and holds a dominant position in the electronics manufacturing industry. Mass availability of raw materials and low-cost labor are the major drivers expected to favor the regional market expansion over the forecast years.

The market in North America is majorly driven by the medical and automotive industries. The medical industry is a high mix–low volume sector, which offers higher profit margins to EMS players in this region. Various R&D centers and medical institutes are located in North America that works on advanced and portable diagnostic products, which they plan to source through contract manufacturers. All these factors are cumulatively expected to spur the regional market expansion over the forecast period.

Key players such as FLEX; Sanmina Corp; and Jabil Circuit, Inc. are planning to expand their manufacturing facilities in Europe, thereby increasing the production capacity. In addition, a shift to advanced manufacturing techniques in America and Europe is estimated to spur EMS demand in these regions over the forecast period.

Electronics manufacturing services are a form of engineering and manufacturing outsourcing services that provide a wide range of core manufacturing capabilities. Moreover, outsourcing of ancillary activities helps OEMs focus on their core competencies, which further helps them improve their operational efficiencies and reduce production costs and need for fixed capital investment.

The EMS model is driven by a contract manufacturer’s ability to specialize in economies of scale in services, industrial design expertise, raw material procurement, and pooling resources, along with offering value-added services such as warranty and repairs. These allow OEMs to avoid having tedious or complex large-scale industrial operations. Moreover, OEMs outsource their circuit assembly requests to reduce time-to-volume and time-to-market production through utilization of technology solutions, design and engineering services, and manufacturing services by EMS providers. On account of these factors, the market for electronic manufacturing services is expected to gain traction over the forecast period.

The proliferation of mobile devices such as tablets and smartphones has been the key growth propeller over the last few years. The medical industry is anticipated to witness significant growth owing to increasing demand for medical devices. Manufacturing of medical devices requires advanced technology and strict regulatory compliance. Thus, outsourcing such activities enables OEMs to accelerate R&D activities and reduce the cost of devices in order to gain a competitive advantage.

Furthermore, automotive and aerospace and defense industries are projected to witness higher growth in comparison to the IT and telecom sector. Despite EMS providers having numerous advantages in the manufacturing processes, contract manufacturing cannot always be the best option for OEMs. Many times, OEMs fail to understand that outsourcing the assembly processes can be more time-consuming and complicated than in-house services. Moreover, maintaining quality, cost control, and production volumes are expected to hamper the manufacturing services provided by EMS contract providers. In the process of passing on the responsibility of manufacturing to experts, OEMs end up making the relationship with contract manufacturers less profitable.

Electronic manufacturing emerged as the leading service segment in 2018 and accounted for over 40% share of the overall revenue that year. However, the electronic design and engineering segment are projected to witness high growth over the forecast period owing to a surging inclination of OEMs toward outsourcing their designing requirements.

The EMS market is witnessing an upsurge in demand for electronic circuit boards due to their rising importance in several electronic devices such as mobile phones and tablets. Furthermore, OEMs can design and test prototypes for new product development. Additionally, services provided by contractors enable less capital investment and advanced manufacturing techniques to OEMs for new product development. Hence, OEMs are increasingly outsourcing their circuit assembly requirements to EMS providers, which substantially increases their profit margins. Owing to the aforementioned factors, demand for EMS is anticipated to upsurge over the forecast period.

Furthermore, OEMs are increasingly considering outsourcing design and engineering activities to reduce operational costs and improve flexibility. They are extensively investing in R&D activities and other initiatives to streamline their production processes in order to sustain in the highly competitive environment. However, utilization of advanced technologies, such as 3D printing and Artificial Intelligence (AI), by EMS providers for automation results in high-initial investment by OEMs. Moreover, the establishment of in-house production is a key challenge faced by the majority of the manufacturers. Thus outsourcing is a preferable option for OEMs to keep pace with growing competitive environment.

Demand for EMS is anticipated to increase owing to the rise in applications across end-use sectors such as healthcare, automotive, industrial, and aerospace and defense. Low penetration of EMS in these sectors is creating higher opportunities for contract manufacturers to establish a strong foothold in these industries.

The IT and telecom sector emerged as the largest end-use segment in the electronic contract manufacturing and design services market and accounted for over 45% of the total revenue in 2018. However, the growing trend of manufacturing outsourcing in the healthcare, automotive, defense, and other segments are projected to spur their market shares over the forecast period.

Furthermore, an upsurge in demand for electrical vehicles has elevated the need to outsource electronic component manufacturing, thereby spurring EMS demand in the automotive sector. The healthcare industry is anticipated to witness significant growth owing to the rise in demand for medical devices. These include computed tomography scanner assemblies, blood analyzers, ultrasound imaging systems, and blood glucose meters.

Escalating need to optimize resources, low fixed capital investment, and improved product development emerged as the key factors contributing to the EMS market expansion across several end-use industries, such as medical, automotive, aerospace and defense, consumer electronics, and IT and telecommunication.

Asia Pacific is expected to witness the highest growth, followed by North America, which is attributed to the rise in outsourcing activities in these regions. Asia Pacific held the largest share in the market in 2018 and is estimated to remain the fastest-growing segment over the forecast period. China accounted for more than 30% share of the overall revenue in 2018 and holds a dominant position in the electronics manufacturing industry. Mass availability of raw materials and low-cost labor are the major drivers expected to favor the regional market expansion over the forecast years.

The market in North America is majorly driven by the medical and automotive industries. The medical industry is a high mix–low volume sector, which offers higher profit margins to EMS players in this region. Various R&D centers and medical institutes are located in North America that works on advanced and portable diagnostic products, which they plan to source through contract manufacturers. All these factors are cumulatively expected to spur the regional market expansion over the forecast period.

Key players such as FLEX; Sanmina Corp; and Jabil Circuit, Inc. are planning to expand their manufacturing facilities in Europe, thereby increasing the production capacity. In addition, a shift to advanced manufacturing techniques in America and Europe is estimated to spur EMS demand in these regions over the forecast period.