OE-A Business Climate Survey: Printed Electronics with Tailwind into 2023

03.08.23

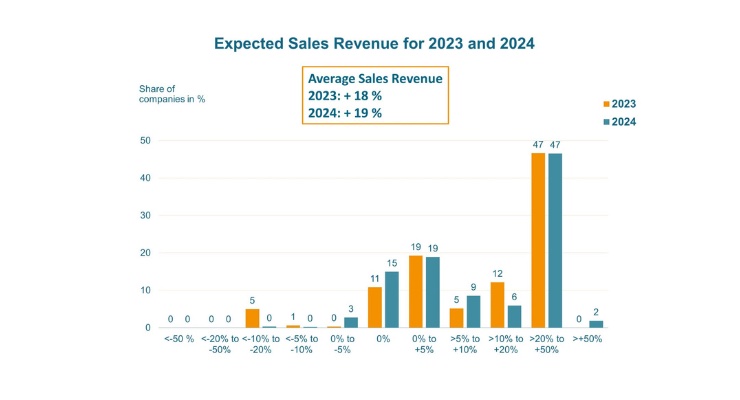

For 2023, revenue growth of 18% forecasted compared to 2022, with companies anticipating growth to continue in 2024.

The results of the recent 2023 OE-A Business Climate Survey demonstrate expectations of continued growth, consistent with projections made in the 2022 survey. For 2023 the responding association members anticipate sales revenue increases of 18% for the flexible and printed electronics industry. The outlook for 2024 is promising as well with an estimated growth of 19%.

“The consistently optimistic results year-on-year in the face of current global uncertainties reflect an underlying confidence in the technologies and applications before us,” said Stan Farnsworth, chair of the OE-A board and chief marketing officer of PulseForge.

The results of the OE-A Business Climate Survey were presented in a special session for the international press at LOPEC 2023 in Munich, Germany. The semi-annual survey is conducted by OE-A (Organic and Printed Electronics Association), an international Working Group within VDMA.

For each survey, every OE-A member organization from throughout the supply chain, from R&D to material suppliers to end users, are asked to provide qualitative data on the state of the industry, expected sales development and markets. The results are on a high level with 76% of the survey participants expecting the industry to continue its positive development in 2023. Leading industries for printed electronics applications are identified by the survey responses as being Consumer Electronics, Automotive, Medical & Pharmaceutical and Building & Architecture.

Despite the good results, the industry battles the impact of the global crisis. Seventy-three percent of respondents note negative effects like supply chain disruptions or price increases.

“The flexible and printed electronics industry members anticipate negative impact due to higher energy cost, inflation, and difficulties in procurement of electronics components,” Farnsworth explained. “Near-term improvements are not expected.”

Yet, the “back to normal” business recovery period is now thought to be shorter than predicted in the past surveys. More than half of the participants (57%) expect a recovery within the next 12 months. Additionally, member companies are reporting an increasing recovery of customer demand, especially in US and Europe, compared to October 2022.

Seventy percent of the surveyed companies will increase investment in production, and more than two-thirds will strengthen their R&D activities in the upcoming half year. Furthermore, the employment situation is encouraging with 55% of the companies planning to increase staff.

“We release the annual Business Climate Survey results here at LOPEC, amongst all of the conference talks, exhibitions, and product demonstrations, because LOPEC is the world’s leading dedicated event to flexible hybrid electronics” stated Farnsworth. “The flexible and printed electronics industry is expanding, and further growth is expected. Here at LOPEC, surrounded by innovation and opportunity, we continue forward towards a positive 2023.”

“The consistently optimistic results year-on-year in the face of current global uncertainties reflect an underlying confidence in the technologies and applications before us,” said Stan Farnsworth, chair of the OE-A board and chief marketing officer of PulseForge.

The results of the OE-A Business Climate Survey were presented in a special session for the international press at LOPEC 2023 in Munich, Germany. The semi-annual survey is conducted by OE-A (Organic and Printed Electronics Association), an international Working Group within VDMA.

For each survey, every OE-A member organization from throughout the supply chain, from R&D to material suppliers to end users, are asked to provide qualitative data on the state of the industry, expected sales development and markets. The results are on a high level with 76% of the survey participants expecting the industry to continue its positive development in 2023. Leading industries for printed electronics applications are identified by the survey responses as being Consumer Electronics, Automotive, Medical & Pharmaceutical and Building & Architecture.

OE-A Expects 18% Sales Growth for 2023

With an expected 18% growth in sales revenue, the printed electronics community turns out to be slightly less optimistic compared to fall 2022 (+24%). For 2024 the positive outlook for the sales revenue growth from October 2022 has been confirmed with 19%.Despite the good results, the industry battles the impact of the global crisis. Seventy-three percent of respondents note negative effects like supply chain disruptions or price increases.

“The flexible and printed electronics industry members anticipate negative impact due to higher energy cost, inflation, and difficulties in procurement of electronics components,” Farnsworth explained. “Near-term improvements are not expected.”

Yet, the “back to normal” business recovery period is now thought to be shorter than predicted in the past surveys. More than half of the participants (57%) expect a recovery within the next 12 months. Additionally, member companies are reporting an increasing recovery of customer demand, especially in US and Europe, compared to October 2022.

Seventy percent of the surveyed companies will increase investment in production, and more than two-thirds will strengthen their R&D activities in the upcoming half year. Furthermore, the employment situation is encouraging with 55% of the companies planning to increase staff.

“We release the annual Business Climate Survey results here at LOPEC, amongst all of the conference talks, exhibitions, and product demonstrations, because LOPEC is the world’s leading dedicated event to flexible hybrid electronics” stated Farnsworth. “The flexible and printed electronics industry is expanding, and further growth is expected. Here at LOPEC, surrounded by innovation and opportunity, we continue forward towards a positive 2023.”