09.12.19

The global conductive textiles market size was estimated at $1.37 billion in 2018, growing at a CAGR of 16.5% from 2019 to 2025, per Grand View Research.

Rising demand for the high tech smart wearables from several end-use industries such as sports & fitness, military, and healthcare are likely to boost market demand in the forecast period.

Growing demand for smart fabrics and smart wearables to track fitness among the population is likely to be a key driver for the market. The rise in the use of such products in the medical industry for health monitoring is expected to bode well for the industry growth. In addition, easy recycling of these textiles is expected to positively influence industry growth.

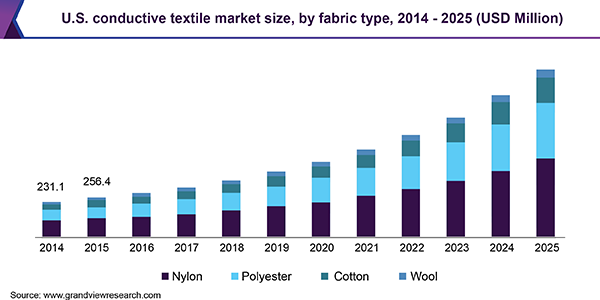

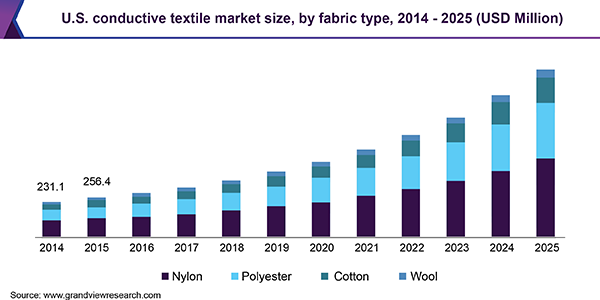

In the U.S., cotton emerged as one of the prominent fabrics used in the industry occupying a market revenue of 15.7% in 2018. The segment is expected to spur market growth owing to its rising use for home and décor purposes such as curtains and beddings to protect from heat and perspiration.

High manufacturing cost of conductive textiles on account of extensive research and development is expected to hamper overall industry growth. Also, the manufacturing process of infusing electronic devices into the garments is cost-intensive subsequently driving up the overall price, which is however expected to reduce with the advent of advanced production technologies.

The rising use of conductive textile in medical devices coupled with the expansion of the usage of conductive textiles using graphene inks is presumed to create more opportunities over the forecast period.

Besides, rising awareness and health consciousness among consumers across the globe are likely to create new opportunities.

Enhanced technology such as antibacterial silver nanoparticles to electrospun graphene fibers is used increasingly in these textiles to gather energy from the environment, to regulate body temperature, and to control muscle vibrations.

Graphene is exclusively used with cotton fabrics to produce conductive cotton apparels. The polyester-based conductive textiles are the second-largest segment accounted for the total revenue share of 33.4% in 2018. Polyester fabric is widely used as it is strong, resistant to most of the chemicals, and shrinking, thus used as a raw material for making conductive wearables such as jackets and sportswear which is expected to drive growth.

Cotton exhibits easier breathability properties and provides superior wearing comfort, which makes it well suited to manufacture conductive textiles. The graphene-based inks when infused with cotton fabric tend to produce conductive wearables without using any toxic substances and are environment-friendly.

In comparison to cotton, nylon, and polyester, wool is expected to register limited growth over the forecast period and accounted for over 7.2% of the revenue share in 2018. Wool being a not very good conductor of heat and weakest of all-natural textile fibers is not preferred much in the manufacturing of conductive textiles.

Nylon fabric has witnessed rapid growth in Asia Pacific in light of the increasing demand and awareness in the region coupled with the presence of a notable apparels manufacturing base. High demand for nylon in the production of conductive textiles due to superior strength and damage resistance is expected to drive the conductive textiles market growth over the next seven years.

Woven textiles segment accounted for the largest revenue share of 47.8% in 2018 and is expected to continue its dominance over the forecast period. These textiles offer high standard performance in terms of conductivity and shielding and thus are preferred by manufacturers across the globe.

Non-woven textiles are expected to be the second-largest and expected to register a notable growth on account of its superior water repellant, abrasion-resistant, flame-resistant properties. Also, growth in the demand for the product in the medical industry is expected to drive the market growth over the next seven years.

Growing demand for non-woven products in numerous industries such as military, healthcare and automotive has resulted in the fast-paced growth of these products. The industry in Asia Pacific is expected to be the fastest-growing region for the aforementioned products owing to the better performance than its substitutes.

The demand for the knitted conductive textiles is expected to be driven by its use in applications including lifestyle, sports, medical, and construction. The growth of the segment is expected to remain relatively slower as compared to woven and non-woven textiles owing to the presence of smaller manufacturing and application industry base.

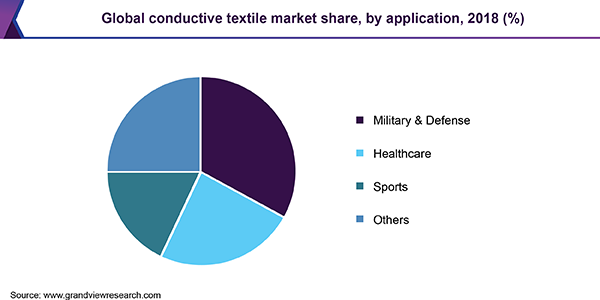

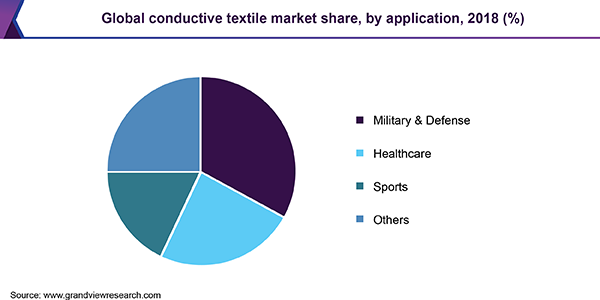

Military and defense segment emerged as a dominant segment in 2018 and accounting for over 32.9% of the revenue share. The segment is expected to gain momentum owing to the rising use of conductive wearables that can monitor the battlefield, track the soldier’s health, and aid in communication and temperature monitoring.

Growth of military spending in emerging markets of China, India & Mexico is expected to emerge a key factor driving conductive textile consumption in military and defense industry. In addition, political uncertainty across the globe coupled with the advent of advanced technology is expected to drive the demand for the product for use in military and defense application.

The healthcare end-use industry is the second largest on account of the high use of the product in antimicrobial wearables and clear room supplies. These products can detect and treat chronic diseases such as cardiovascular, diabetes, respiratory problems and neurological disorders which are expected to drive the segment growth over the forecast period.

Increasing health consciousness and fitness habits among the consumers in emerging markets such as China and India is projected to propel the demand for the sector in these regions. Moreover, the anti-radiation and heat resistant properties of these textiles are further expected to propel the industry growth over the next seven years.

The industry in Europe emerged as the dominant region accounting for 35.9% of the total revenue share in 2018 and is expected to continue its dominance over the next seven years. Germany alone accounts for the highest share of the entire European market owing to the presence of advanced infrastructure & technology, automotive heritage, and a highly-skilled workforce.

The demand for the product in North America was dominated by the nylon fabric owing to its conductive and better performance in terms of protection. Additionally, the presence of huge technology-based populace and continuous R&D activities are expected to boost the product demand over the forecast period.

Increasing awareness among the population in Asia Pacific regarding the use of conductive wearables and transitioning trend towards health consciousness is expected to drive the market over the next seven years. Also, factors such as the rising population, improving economic conditions and booming manufacturing sectors are projected to positively impact industry growth.

The share of Central & South America in the overall market has been low on account of the limited presence of the application industries. The nylon fabric type is expected to dominate the conductive textile market in Brazil. The increasing awareness regarding the smoothness and resilient properties of nylon it is being highly used as a raw material for manufacturing conductive garments.

Rising demand for the high tech smart wearables from several end-use industries such as sports & fitness, military, and healthcare are likely to boost market demand in the forecast period.

Growing demand for smart fabrics and smart wearables to track fitness among the population is likely to be a key driver for the market. The rise in the use of such products in the medical industry for health monitoring is expected to bode well for the industry growth. In addition, easy recycling of these textiles is expected to positively influence industry growth.

In the U.S., cotton emerged as one of the prominent fabrics used in the industry occupying a market revenue of 15.7% in 2018. The segment is expected to spur market growth owing to its rising use for home and décor purposes such as curtains and beddings to protect from heat and perspiration.

High manufacturing cost of conductive textiles on account of extensive research and development is expected to hamper overall industry growth. Also, the manufacturing process of infusing electronic devices into the garments is cost-intensive subsequently driving up the overall price, which is however expected to reduce with the advent of advanced production technologies.

The rising use of conductive textile in medical devices coupled with the expansion of the usage of conductive textiles using graphene inks is presumed to create more opportunities over the forecast period.

Besides, rising awareness and health consciousness among consumers across the globe are likely to create new opportunities.

Enhanced technology such as antibacterial silver nanoparticles to electrospun graphene fibers is used increasingly in these textiles to gather energy from the environment, to regulate body temperature, and to control muscle vibrations.

Graphene is exclusively used with cotton fabrics to produce conductive cotton apparels. The polyester-based conductive textiles are the second-largest segment accounted for the total revenue share of 33.4% in 2018. Polyester fabric is widely used as it is strong, resistant to most of the chemicals, and shrinking, thus used as a raw material for making conductive wearables such as jackets and sportswear which is expected to drive growth.

Cotton exhibits easier breathability properties and provides superior wearing comfort, which makes it well suited to manufacture conductive textiles. The graphene-based inks when infused with cotton fabric tend to produce conductive wearables without using any toxic substances and are environment-friendly.

In comparison to cotton, nylon, and polyester, wool is expected to register limited growth over the forecast period and accounted for over 7.2% of the revenue share in 2018. Wool being a not very good conductor of heat and weakest of all-natural textile fibers is not preferred much in the manufacturing of conductive textiles.

Nylon fabric has witnessed rapid growth in Asia Pacific in light of the increasing demand and awareness in the region coupled with the presence of a notable apparels manufacturing base. High demand for nylon in the production of conductive textiles due to superior strength and damage resistance is expected to drive the conductive textiles market growth over the next seven years.

Woven textiles segment accounted for the largest revenue share of 47.8% in 2018 and is expected to continue its dominance over the forecast period. These textiles offer high standard performance in terms of conductivity and shielding and thus are preferred by manufacturers across the globe.

Non-woven textiles are expected to be the second-largest and expected to register a notable growth on account of its superior water repellant, abrasion-resistant, flame-resistant properties. Also, growth in the demand for the product in the medical industry is expected to drive the market growth over the next seven years.

Growing demand for non-woven products in numerous industries such as military, healthcare and automotive has resulted in the fast-paced growth of these products. The industry in Asia Pacific is expected to be the fastest-growing region for the aforementioned products owing to the better performance than its substitutes.

The demand for the knitted conductive textiles is expected to be driven by its use in applications including lifestyle, sports, medical, and construction. The growth of the segment is expected to remain relatively slower as compared to woven and non-woven textiles owing to the presence of smaller manufacturing and application industry base.

Military and defense segment emerged as a dominant segment in 2018 and accounting for over 32.9% of the revenue share. The segment is expected to gain momentum owing to the rising use of conductive wearables that can monitor the battlefield, track the soldier’s health, and aid in communication and temperature monitoring.

Growth of military spending in emerging markets of China, India & Mexico is expected to emerge a key factor driving conductive textile consumption in military and defense industry. In addition, political uncertainty across the globe coupled with the advent of advanced technology is expected to drive the demand for the product for use in military and defense application.

The healthcare end-use industry is the second largest on account of the high use of the product in antimicrobial wearables and clear room supplies. These products can detect and treat chronic diseases such as cardiovascular, diabetes, respiratory problems and neurological disorders which are expected to drive the segment growth over the forecast period.

Increasing health consciousness and fitness habits among the consumers in emerging markets such as China and India is projected to propel the demand for the sector in these regions. Moreover, the anti-radiation and heat resistant properties of these textiles are further expected to propel the industry growth over the next seven years.

The industry in Europe emerged as the dominant region accounting for 35.9% of the total revenue share in 2018 and is expected to continue its dominance over the next seven years. Germany alone accounts for the highest share of the entire European market owing to the presence of advanced infrastructure & technology, automotive heritage, and a highly-skilled workforce.

The demand for the product in North America was dominated by the nylon fabric owing to its conductive and better performance in terms of protection. Additionally, the presence of huge technology-based populace and continuous R&D activities are expected to boost the product demand over the forecast period.

Increasing awareness among the population in Asia Pacific regarding the use of conductive wearables and transitioning trend towards health consciousness is expected to drive the market over the next seven years. Also, factors such as the rising population, improving economic conditions and booming manufacturing sectors are projected to positively impact industry growth.

The share of Central & South America in the overall market has been low on account of the limited presence of the application industries. The nylon fabric type is expected to dominate the conductive textile market in Brazil. The increasing awareness regarding the smoothness and resilient properties of nylon it is being highly used as a raw material for manufacturing conductive garments.